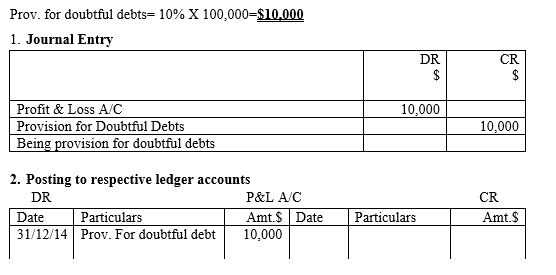

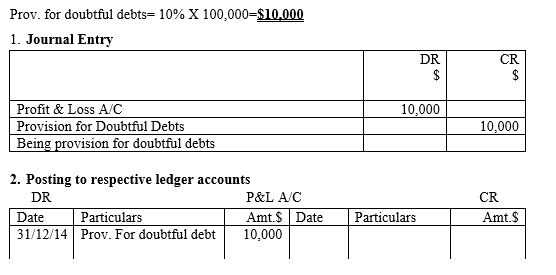

Double Entry for Provision for Doubtful Debts

Anonymous What would be the double entry if a specific provision for doubtful debts which was made is paid in the next year. The following year if you felt the provision needed to be lowered as the potential bad debt was now paid and future debts did not have the same likelihood of going bad then you could cancel.

Accounting Nest Intermediate Bad Debts And Provision For Doubtful Debts

We also learned that all individual debtor T-accounts go in the debtors ledger and all individual creditor T-accounts go in the creditors ledger.

. 6000 have been omitted be recorded in the books. As previously mentioned we not only have the general ledger but also two other subsidiary or supporting ledgers. 1480 for accrued income are be shown in the books.

Specific Provision for Doubtful Debts Subsequently Paid by. On 1 January 2016 the trade receivables amounted to 3500 and the provision for doubtful debts was 175. The income statement for the year ended 31 December 2016 was debited with 15 for the provision of doubtful debts.

Enter the email address you signed up with and well email you a reset link. - The Debtors Ledger - The Creditors Ledger. For example here is a debtors ledger with a number of individual.

5 provision be made for doubtful debts on Debtors and a provision of 2 be made on Debtors and Creditors for discount. Enter the email address you signed up with and well email you a reset link. 20 Sumit maintains a position for doubtful debts at 5 of the trade receivables at the end of each financial year.

1000 are prepaid for insurance. 5000 are outstanding for salaries.

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Understand How To Enter The Provision For Bad Debts Transactions Using The Double Entry System Youtube

Bad Debt Provision Accounting Double Entry Bookkeeping

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Comments

Post a Comment